Students should read the Central Banking ICSE Economics Class 10 notes provided below. These revision notes have been prepared based on the latest ICSE Economics Books for Class 10 issued for the current academic year. Our teachers have designed thee notes for the students are able to understand all topics given in Economics in standard 10 and get good marks in exams

ICSE Class 10 Economics Central Banking Revision Notes

Students can refer to the quick revision notes prepared for Chapter Economics Central Banking in Class 10 ICSE. These notes will be really helpful for the students giving the Economics exam in ICSE Class 10. Our teachers have prepared these concept notes based on the latest ICSE syllabus and ICSE books issued for the current academic year. Please refer to Chapter wise notes for ICSE Class 10 Economics provided on our website.

Meaning of Central Bank

A Central Bank is the apex bank which controls the entire banking system of a country. It has the sole authority to issue notes in that country. It also acts as a banker to the government and controls the supply of money in the country.

Differences between the Central Bank and a Commercial Bank

- The Central Bank is the apex bank and is also known as a bank of all the banks. A Commercial Bank functions under the control of the Central Bank.

- The Central Bank focuses on social welfare, whereas a Commercial Bank focuses on profit maximisation.

- The Central Bank does not accept deposits, whereas a Commercial Bank accepts deposits from the public and provides loans to individuals and households.

- The Central Bank issues currency, whereas a Commercial Bank has no authority to issue currency.

- The Central Bank is an advisor to the government on monetary issues, whereas a Commercial Bank is not an advisor.

Reserve Bank of India: Functions

On 1st April 1935, the Reserve Bank of India (RBI) was established according to the RBI Act, 1934. This bank was established as a joint stock bank with a share capital of Rs 5 crore. On 1st January 1949, the RBI was nationalised by the Government of India and it started functioning as a Central Bank of India since then.

- Issuing of notes: The Central Bank of a country has an exclusive right of issuing notes. Under the original Act, there was provision for issuing currency notes according to the proportional reserve system. In India, the RBI can print or issue any volume of currency or notes by keeping a gold reserve worth Rs 115 crore and foreign exchange worth Rs 85 crore.

- Banker to the government: The Central Bank is also a banker, agent and financial advisor to the government. As a banker, it manages government accounts across the country. It buys and sells securities on behalf of the government as its agent. It helps the government in framing policies to regulate the money market by acting as an advisor to the government.

- Lender of the resort: The Central Bank also provides financial assistance to commercial banks by rediscounting eligible bills of exchange. When the commercial banks do not get loan facilities from any other sources, they approach the Central Bank as a last resort. The Central Bank advances loans to such banks against approved securities.

- Custodian of the cash reserve: The RBI acts as the custodian of foreign exchange reserves of India. One of the essential activities of the RBI is maintaining the external value of the Indian Rupee. The RBI has the authority to enter foreign exchange transactions both on its own account and on behalf of the government. The market rate of exchange of the rupee is determined by the forces of demand for and supply of foreign currencies in India. The RBI has the discretion to intervene in the foreign exchange market through the purchase and sale of foreign currencies.

- Controlling credit: The Central Bank increases or decreases the supply of money by regulating the creation of credit by commercial banks. Uncontrolled credit causes economic fluctuations. The Central Bank establishes stability not only in the internal price level but also in the foreign exchange rates to control the credit effectively. This kind of stability is essential for economic growth and development of the economy.

- Other functions: The RBI maintains relations with international organisations such as International Monetary Fund and World Bank. It also performs a variety of developmental and promotional functions. It has also been entrusted with collecting and compiling statistical information related to banking and other financial sectors of the economy.

Methods of Credit Control

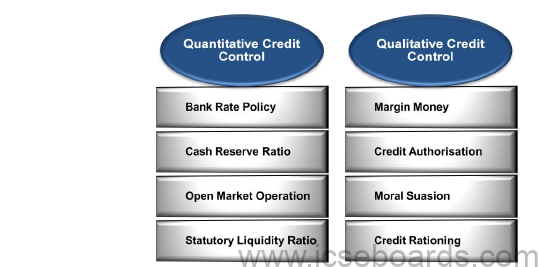

Quantitative Credit Control

Quantitative measures of credit control are those which affect the overall supply of money in an economy. These measures do not restrict the flow of credit to some specific sectors of the economy.

- Bank Rate Policy: Bank rate policy is used as the main instrument of monetary control during inflation.

When the Central Bank raises the bank rate, it is said to have adopted a dear money policy. The increase in bank rate increases the cost of borrowing which reduces commercial banks borrowing from the Central Bank. Consequently, the flow of money from the commercial banks to the public reduces. Therefore, inflation arising because of bank credit is controlled. - Cash Reserve Ratio (CRR): The CRR is the necessary minimum percentage of a bank’s total deposits that is to be kept with the Central Bank. According to the RBI Act, 1934, every commercial bank needs to maintain with the Central Bank a certain percentage of their deposits in the form of cash reserves. By an amendment of the Act in 1962, the Central Bank can vary the CRR between 3% and 15% of the total deposits of commercial banks.

- During inflation, the Central Bank increases the CRR, and thereby the funds for providing loans with the commercial banks decrease. In this process, the flow of credit and the aggregate demand is reduced. Thus, the process of credit creation by the commercial bank is checked and helps control the inflation. On the other hand, the RBI reduces the CRR to curb the deflation situation.

- Open Market Operation: Open market operations refer to the sale and purchase of government securities and bonds by the Central Bank. While controlling inflation, the Central Bank sells government securities to the public through banks. This results in the transfer of a part of bank deposits to the Central Bank account and reduces the credit creation capacity of commercial banks.

- Statutory Liquidity Ratio (SLR): SLR is the fixed percentage of assets in the form of cash or other liquid assets which a bank must maintain with the Central Bank. The Central Bank can vary the SLR between 20% and 40%.

Qualitative Credit Control

Qualitative measures of credit control are those which focus on the alternative uses of credit in an economy. These measures control the flow of credit to specified areas of economic activity.

- Margin Money: This implies the minimum margins to be kept by the borrowers with commercial banks while borrowing money against specific securities from commercial banks.

- Credit Authorisation Scheme: This shows the ceiling on the amount of credit for certain purposes and requires prior sanction of the RBI.

- Moral Suasion: Moral suasion is a mixture of both persuasion and pressure. The Central Bank makes an attempt to persuade commercial banks to follow its directives of monetary policy or it can pressurise them to follow its policy directives. When it fails to work, the Central Bank can use direct action which includes non-recognition of a commercial bank.

- Rationing of Credit: Quota system was introduced in 1960. The RBI fixes credit quota for member banks. If the member bank seeks more loan than their fixed quota, they will have to pay higher interest.